LATEST INSIGHTS

Federal Budget recap by Synergy

Last night’s Federal Budget release saw a number of announcements for individuals and businesses. Below the Synergy Accountants and Synergy Business Finance team have recapped what the 2022 Federal Budget means to you.

Individuals

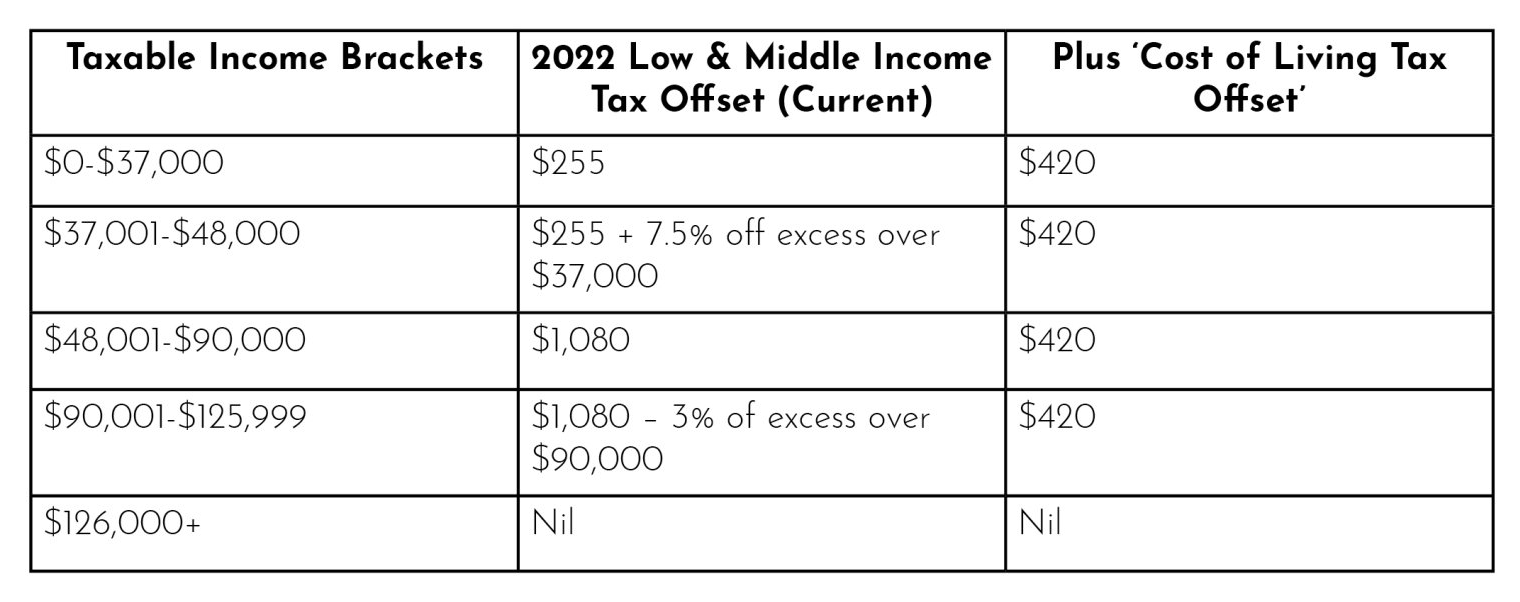

The Government announced a ‘cost of living tax offset‘ for the 2022 income year of $420, provided by an increase to the existing low & middle income tax offset. This will result in a maximum benefit of the low & medium income tax offset of $1,500 for individuals and $3,000 for couples – paid from July 2022 and on lodgement of the 2022 individual income tax returns.

“All low & middle income tax offset recipients will benefit from the full $420 increase, except for those who don’t need the full offset to reduce their tax liability” Synergy Accountants Director Dan Chappel said.

The proposed increases are broken down in the below table:

The Low & Medium Tax Offset is not available from the 2023 income year.

“Additionally, the Government will increase the Medicare levy low-income thresholds for singles, families, seniors and pensioners from 1 July 2021” Mr Chappel added.

Meaning the threshold for singles will increase from $23,226 to $23,365, while the threshold for families will be increased from $39,167 to $39,402.

For single seniors and pensioners, the threshold will increase from $36,705 to $36,925 and the family threshold for seniors and pensioners will increase from $51,094 to $51,401.

In addition to this the family income thresholds will also increase for each dependent child or student by a further $3,619, up from the previous figure of $3,597.

The costs of COVID-19 tests will be tax deductible when in relation to attending a place of work from 1 July 2021. The Government will also ensure Fringe Benefit Tax will not be incurred by businesses where COVID-19 tests are provided to employees for this purpose.

Small to Medium Business

A training boost to support small and medium businesses to upskill current employees will apply to eligible expenses from 29 March 2022 until 20 June 2024.

Businesses with aggregated annual turnover of less than $50 million will be able to deduct an additional 20% of the eligible expense (a total of 120% of the total expense amount) incurred on external employee training courses. While all courses must be provided to employees within Australia or online and be provided by entities registered in Australia.

Please note that in-house, on the job training and external training courses for non-employees will be excluded from the training boost.

For eligible expenditure incurred by 30 June 2022, the boost will be claimed in the 2023 year income tax return, while eligible expenditure incurred from 1 July 2022 – 30 June 2024, the boost will be claimed in the income year in which it is incurred.

Additionally, a technology investment boost to promote digital innovation for small and medium business was announced in this 2022/23 budget. The boost will apply for eligible expenses incurred from 7.30pm (AEDT) 29 March 2022 until 30 June 2023.

A deduction of an additional 20% (a total of 120% of the amount) on eligible business expenses and depreciating assets that support further digital adoption within a business environment will be available for small and medium businesses with an aggregated annual turnover of less than $50 million.

Like the training boost, eligible expenditure incurred by 30 June 2022 the technology investment boost will be claimed in the 2023 year income tax return. For eligible expenditure incurred from 1 July 2022 – 30 June 2023, the technology investment boost will be claimed in the income year in which it is incurred.

The technology investment boost could include expenses like portable payment devices, cyber security systems or subscriptions to cloud-based services with an annual cap of $100,000 per year.

Further to the budgets active COVID-19 responses, the Government have extended certain payments received under COVID-19 business support programs as non-assessable non-exempt income for income tax purposes until 30 June 2022.

“For Queensland clients, the 2021 COVID-19 Business Support Grant remains eligible” Dan added.

Superannuation

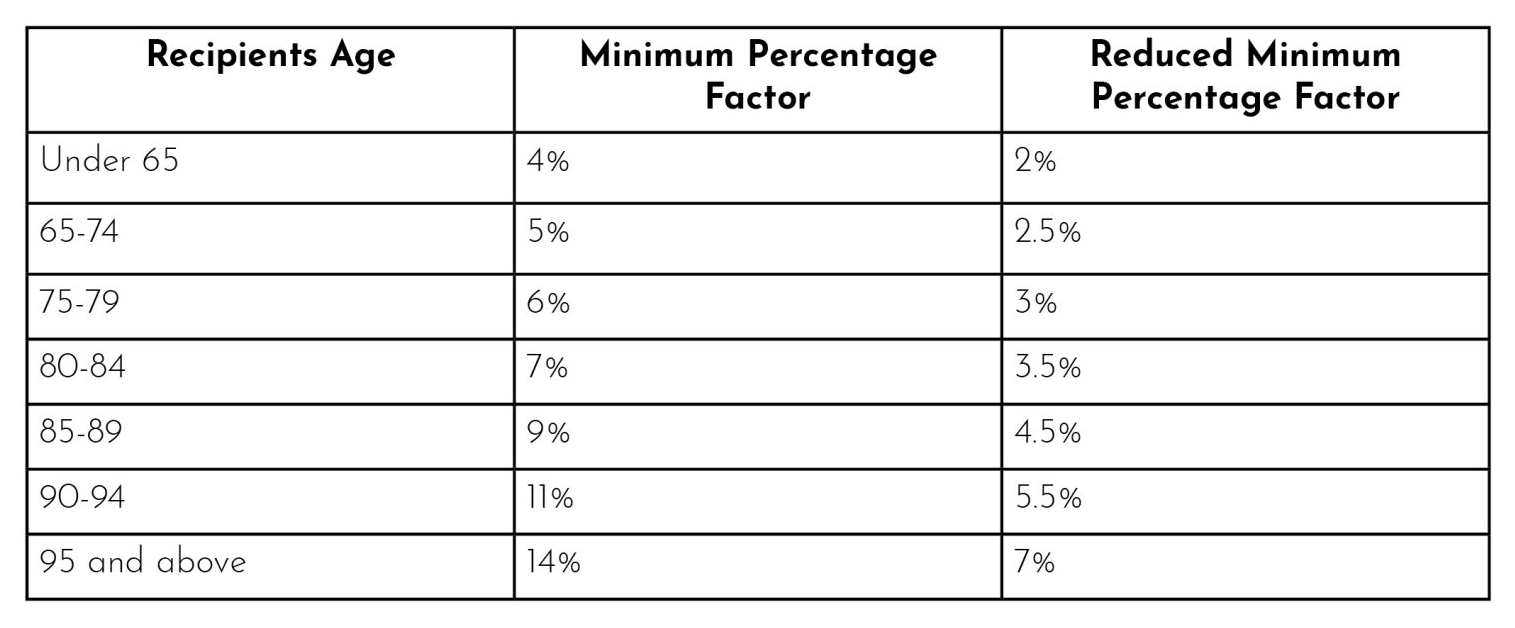

The Government will continue with the 50% reduction of superannuation minimum drawdown requirements for account-based pensions and similar products for another year through to 30 June 2023.

The minimum and reduced minimum percentage drawdowns are summarised below;

Cost of living

The Government recognises the increases in the cost of living expenses for Australians and introduced a number of initiatives to provide support, including the one-off $250 cost of living payment.

“This payment will be made from April 2022 to eligible Australian’s who receive certain government assistance payments and concession cardholders” Mr Chappel said.

The $250 cost of living payment will be exempt from tax and will not be regarded as income support for the purposes of any income support payments.

For a complete list of eligible receipts, please see the Budget 2022-23 link, here.

“Finally, with the drastic increase in fuel prices, the government has announced that they will reduce the excise and excise-equivalent customs duty rate applicable to petrol, diesel and other fuel/petroleum based products by 50%, however aviation fuels are excluded.” Mr Chappel said.

The measure will commence from 12.01am on 20 March 2022.