LATEST INSIGHTS

2023/24 Federal Budget recap by Synergy

Last night’s Federal Budget release saw a number of announcements for individuals and businesses. Below the Synergy Accountants and Synergy Business Finance team have recapped what the 2023 Federal Budget means to you.

Key findings

Here's a recap of the broader takeaways, while we expand on the key points that will effect our clients in the full Blog below:

- Small Business Asset Write-off: One-year small business instant asset write-off for assets up to $20k.

- Small Business Amnesty Period: Actions to help late lodgers re-engage with the tax system with penalty remissions

- Small Business Energy Incentive: One-year Small Business Energy Incentive to switch to efficient energy sources.

- Household Energy Upgrade fund: $1.3 billion Household Energy Upgrade Fund for home upgrades that save energy.

- Superannuation Tax: Future earnings on super balances over $3 million will be taxed are an additional 15 per cent from 1 July 2024.

- Change to Super Guarantee Contributions: Employers will be required to pay compulsory super guarantee contributions on payday rather than quarterly (*from 1 July 2026)

Tax Measures

The federal budget has proposed several measures to support small businesses in Australia. The instant asset write-off threshold will be increased to $20,000 for the 2023-24 financial year for businesses with an aggregated annual turnover of less than $10 million. This increase will apply on a per asset basis, allowing small businesses to claim larger deductions for individual assets.

In addition, businesses with an annual turnover of less than $50 million will be eligible for a Small Business Energy Incentive, allowing them to claim an additional 20% deduction on spending that supports electrification and more efficient use of energy. To qualify for the incentive, eligible assets or upgrades will need to be first used or installed ready for use between 1 July 2023 and 30 June 2024.

Small businesses with an aggregate turnover of less than $10 million will also be provided with a lodgement penalty amnesty to encourage them to re-engage with the tax system. The amnesty will remit failure-to-lodge penalties for outstanding tax statements lodged in the period from 1 June 2023 to 31 December 2023 that were originally due between 1 December 2019 to 29 February 2022.

Additionally, the government has announced an incentive to support the construction of eligible build-to-rent properties. For new build-to-rent projects where construction commences after 7:30 PM AEST on 9 May 2023, the capital works tax deduction rate (depreciation) will be increased to 4% per year, up from the previous rate of 2.5%.

This incentive is designed to encourage the development of more rental properties in Australia, providing more options for those seeking affordable and secure housing.

Superannuation Measures

The budget also included several updates related to superannuation in Australia. Beginning on 1 July 2025, an additional 15% tax will be applied to super account balances exceeding $3 million. This means that the planned 15% tax on an individual's super balance exceeding $3 million will apply to both realised and unrealised gains and losses on an accruals basis. If you have an asset that increases in value, but has not yet been sold, you would still pay tax on this unrealised gain in value under the new rules.

From 1 July 2026, employers will be required to pay their employees' super guarantee at the same time as their salary and wages, a measure known as "payday super."

Although there is little information provided in the Budget documents, it is anticipated that the ATO and Treasury will collaborate closely with industry and interested parties regarding these modifications in the latter part of 2023. The final framework will be assessed as a component of the 2024-25 Budget.

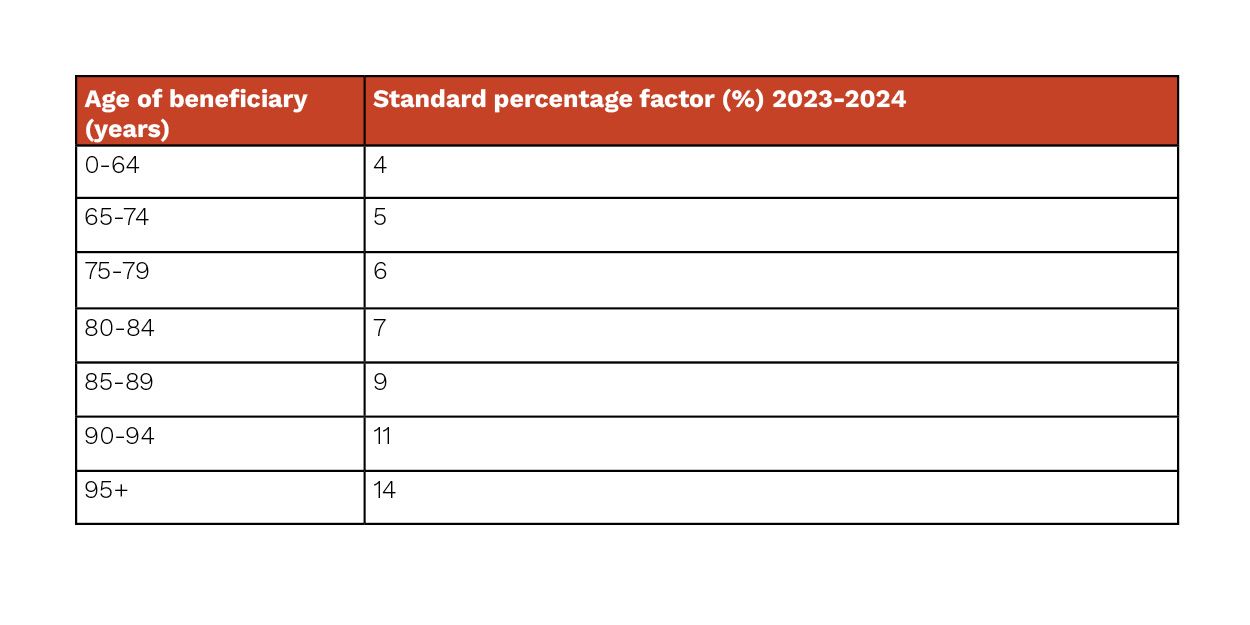

The budget did not announce a further extension to 2023-24 of the temporary 50% reduction in the minimum annual payment amounts for superannuation pensions and annuities. This means that minimum pension drawdown amounts will be as follows:

Individuals & Households

The Government has teamed up with state and territory governments to provide eligible households and small businesses with up to $3 billion in electricity bill relief. Starting July 2023, this initiative will offer eligible households up to $500 and eligible small businesses up to $650 in electricity bill relief.

Home ownership is set to become a closer reality for many Australians thanks to changes to the Home Guarantee Scheme. The Home Guarantee Scheme will be more inclusive, allowing more Australians to own a home sooner. The eligibility criteria for the First Home Guarantee and Regional First Home Guarantee will be extended to include eligible borrowers beyond married and de facto couples, as well as non-first home buyers who haven't owned a property in the last decade. Additionally, Australian Permanent Residents will now be able to participate in the Home Guarantee Scheme, along with Australian citizens.

Personal Taxation

As part of the 2023-24 federal budget, the Australian government did not announce any changes to personal tax rates. This means that the current tax rates will remain in effect for the coming year.

Additionally, the Stage 3 tax changes that were previously legislated will begin as planned on 1 July 2024 unless changed in the next budget. These changes are set to remain unchanged and will take effect in the 2024-25 financial year.

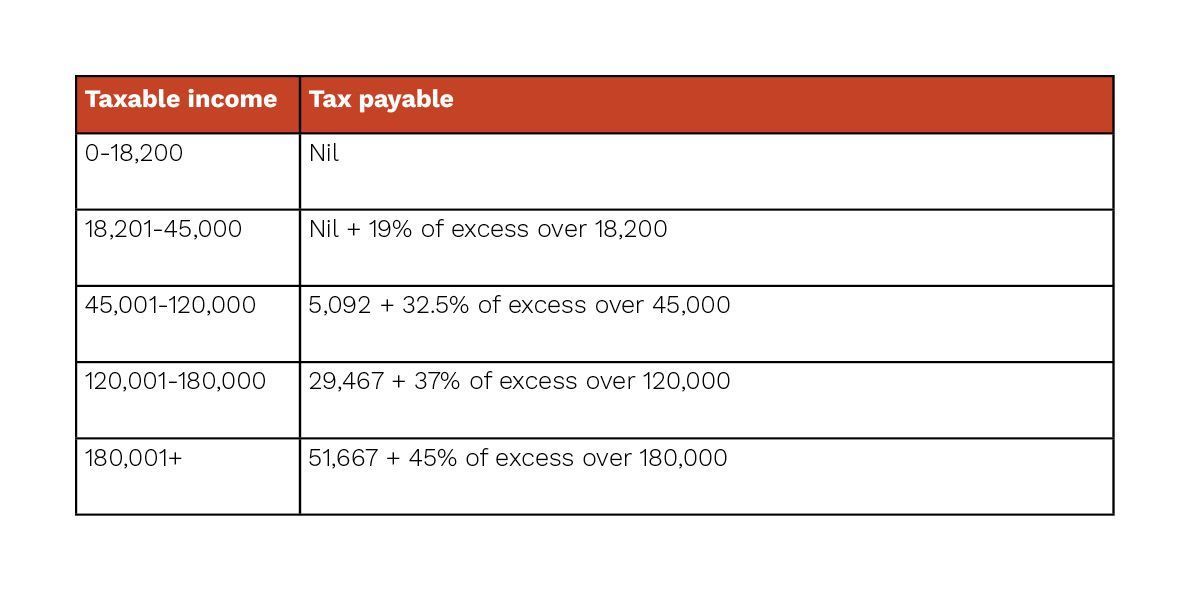

Resident rates and thresholds for 2023-24

The below graph displays the 2023-24 tax rates and income thresholds for residents (unchanged since 2021-22) are:

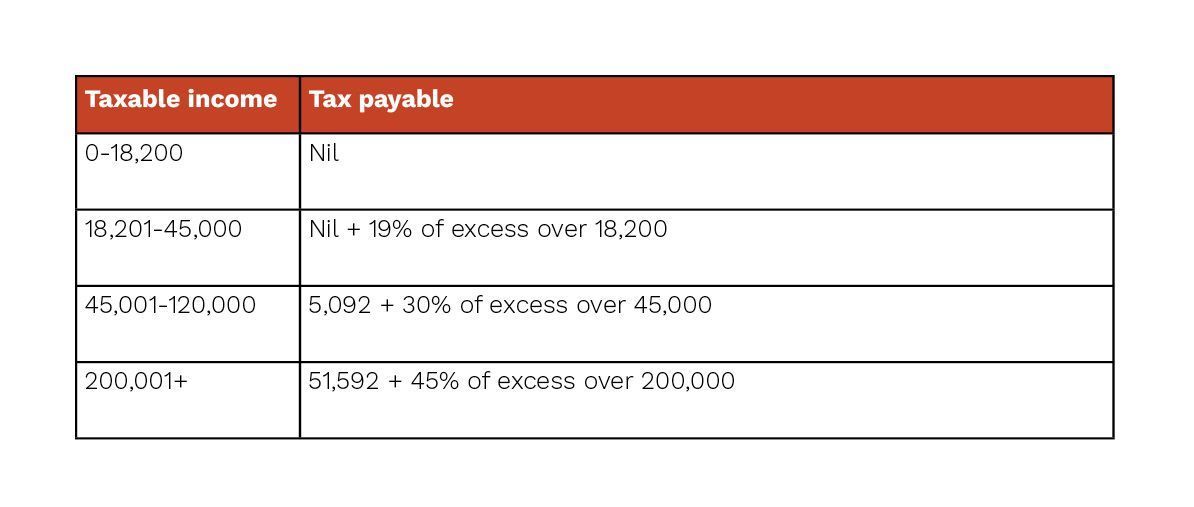

Resident rates and thresholds – from 2024-25 onwards

The tax rates and income thresholds from the 2024-25 for residents (as already legislated) are:

Small Business

Starting from 1 July 2023 until 30 June 2024, the Australian Government will provide temporary relief to small businesses by increasing the instant asset write-off threshold to $20,000. This means that small businesses with an annual turnover of less than $10 million can immediately deduct the full cost of eligible assets that cost less than $20,000, as long as they are first used or installed ready for use within the specified time period.

The new threshold will apply on a per-asset basis, allowing small businesses to instantly write off multiple assets. Any assets valued at $20,000 or more, which cannot be immediately deducted, can still be placed into the small business simplified depreciation pool.

As per the Budget papers, small businesses with an annual turnover of less than $50 million will be eligible for the Small Business Energy Incentive. This measure provides an additional 20% deduction on spending that supports the use of electricity and energy efficiency. The incentive was first announced by the Treasurer on April 30, 2023.

The Small Business Energy Incentive will offer businesses an opportunity to claim a bonus tax deduction of up to $20,000 for spending on electrification and energy-efficient upgrades. Total expenditure of up to $100,000 will be eligible for the incentive.

To qualify for the incentive, businesses must have assets or upgrades that are first used or installed and ready for use between 1 July 2023 and 30 June 2024. The eligibility criteria will be finalised after consulting with stakeholders.

Approximately 2.1 million eligible small businesses will also receive cashflow relief as the Government will reduce the increase in their quarterly tax instalments for GST and income tax in 2023-24. Instead of the usual 12%, the instalments will only increase by 6%.

Business taxation

According to the Budget Papers, the Prime Minister announced measures to boost the housing supply, which have been confirmed. For new eligible build-to-rent projects starting construction after 7:30 PM AEST on May 9, 2023, the Government will increase the capital works tax deduction rate to 4% per year and reduce the final withholding tax rate on eligible fund payments from managed investment trust investments from 30% to 15%.

To qualify for the

building allowance, the build-to-rent projects must have at least 50 apartments or dwellings available for rent to the general public, be retained under single ownership for a minimum of 10 years before they can be sold, and landlords must offer a lease term of at least three years for each dwelling. Currently, the rate for income-producing buildings constructed after February 27, 1992, is 2.5%, except for short-term traveller accommodation and industrial buildings, which are eligible for a 4% rate.

LATEST

INSIGHTS.

GET IN TOUCH.

PHONE:

1300 324 588

TOOWOOMBA OFFICE

Level 3, Toowoomba City, 3/482 Ruthven St, 4350, QLD, Australia

SUNSHINE COAST OFFICE

Tower 2, Level 5/Maroochydore, 55 Plaza Pde, Queensland, Australia

SYNERGY CONSOLIDATED

SYNERGY ACCOUNTANTS

SYNERGY BUSINESS FINANCE

SYNERGY MORTGAGE BROKERS

Liability limited by a scheme approved under Professional Standards Legislation.

Synergy Business Finance ABN 27 649 662 493

Credit Representative Number 532594 is authorised under Australian Credit Licence 389328

© 2022 Synergy Consolidated - All Rights Reserved